With more than $500 million in yearly revenues and rising, Walmart has been giving Amazon a run for its money as of late.

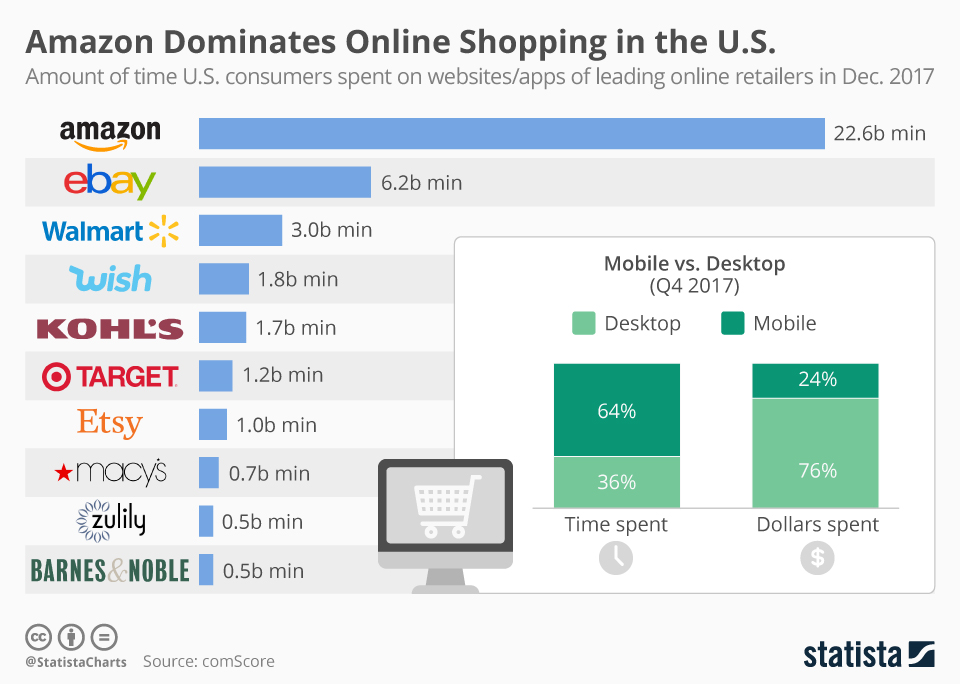

Amazon has been one of the fastest growing companies this decade, blowing away and swallowing up competitors to become the world’s 2nd company to surpass the trillion dollar valuation mark last September 2018. Amazon is well known for giving consumers a great user experience on their platforms, but Walmart secured the No. #1 spot on the Fortune 500 list for the sixth year in a row last year; a feat that Amazon has yet to achieve. Walmart was able to catch up quickly to Amazon by means of strategic acquisitions and added features that helped them garner a larger slice of the e-commerce pie and compete head on with Amazon.

Walmart vs Amazon

Even though Amazon has dominated the news recently as it continues to make life difficult for brick-and-mortar retailers, Walmart has always been at the top of the list for stock market investors. Walmart is beginning to use its nationwide network of physical store locations to their advantage to offer services that customers want. This physical infrastructure is something that Amazon doesn’t have currently nor has the experience to develop at the scale and effectiveness that Walmart has.

For years, Walmart and Amazon have been butting heads in competing with different features and discounts to get customers more excited at the notion of merging their brick-and-mortar experience with their eCommerce experience. In this way, both companies are attacking the problem at opposite ends of the spectrum. While Walmart has tried to secure its eCommerce foothold, Amazon has fought to increase its physical store presence and acquire more foot traffic and brand visibility.

Amazon’s Troubles

Amazon has been working for years on revolutionizing the self-serve convenience store with Amazon Go. This cashless and cashierless, surveillance-based concept was first detailed in 2016, with the first public Go Store opening in January 2018 in Seattle, Washington. Amazon also tried its hand at opening up its own “Pop-Up” stores within malls, Whole Foods, and Kohl’s across America. Unfortunately, the bubble burst on those Pop-Up stores recently, with Amazon’s announcement that they will close all 87 of their U.S.-based Pop-Up stores in April 2019. With Amazon looking to open as many as 3,000 Amazon Go stores by 2021, the move may be strategic for them to offload certain fixed costs so that they can accommodate this monumental construction task.

The move might also come at a tumultuous time for Amazon as they have found it difficult to contain costs in order to keep its prices low and compete with Walmart. Amazon’s effort to build an army of independently-contracted delivery drivers has allowed them to carry out their domination of the free shipping eCommerce marketplace, but the costs to sustainably maintain such an army might not be worth it in the long term. Amazon drivers claim they’ve been worked like employees, but only paid like contractors since the company prefers to cap their wages regardless of the amount of work done.

This has led to multiple class-action lawsuits from employees on top of the IP lawsuits from companies such as Williams Sonoma, eBay, and even director Woody Allen. Even though Amazon has been seeing their profit margins widen recently, the increase in legal fees is certain to eat into margins and affect the company’s bottom line more than they had originally anticipated.

Walmart’s Recent Successes

Walmart hasn’t had to shoulder the same brick-and-mortar growing pains as Amazon has. Instead, Walmart is looking for opportunities to bring the in-store and online arms of its business together, to offer customers unique ways to access its products and services. No matter your personal opinion on Walmart as a consumer, you can’t deny that they are the kings of the in-store user experience. Co-Founder of Twitter Evan Williams attests that “user experience is everything. It always has been, but it’s undervalued and underinvested in. If you don’t know user-centered design, study it. Hire people who know it. Obsess over it. Live and breathe it. Get your whole company on board.” Walmart may not have been an early adopter of eCommerce, but they do have their finger to the pulse of their customers and as such are able to better anticipate the features that they crave in their shopping experiences.

It is specifically these customer experience insights that have allowed Walmart to take their brick-and-mortar successes to the digital realm. Case in point, Walmart’s e-commerce sales were up a staggering 43% for Q4 2019 with Sam’s Club eCommerce sales growing by 21%. Walmart is attributing this increase in eCommerce growth to their omnichannel fulfillment model that allows them to widen their customer base and attract more than just value shoppers.

Free Shipping

Less than a year after it’s initial launch, Walmart decided to offload its ShippingPass service. At $49/year, ShippingPass offered unlimited delivery, but it wasn’t enough to compete with Amazon Prime. Walmart took the feedback from their customers and the initial trial run of ShippingPass, and decided to give all customers two-day shipping on all orders over $35. What Walmart and other retailers who have been watching this unfold have realized is that customers (for the most part) don’t want to be tied down to memberships and don’t want to spend $50 just to get free shipping. Lowering the threshold by just $15 per order opened the door to record sales growth for Walmart.

According to CFO Brian Olsavsky, On April 26th, Amazon has officially presented its desire to "make one-day shipping the new standard" for its Prime Members Program. The e-commerce giant has allocated $800 million to the effort. Here's what people are saying about the new strategy for attracting "the next wave of customers".

It comes down to the fact that Walmart's two-day shipping easily beats Amazon's 5-8 day delivery window that non-Prime members are stuck with. In this way, Walmart has found that quicker delivery trumps an all-inclusive package for their customers every time. Of course, Amazon reacted by lowering its free shipping minimum and even one-upped Walmart by acquiring Whole Foods, thus giving Amazon a much larger brick-and-mortar presence. But in the end, Amazon customers aren’t motivated by price decreases, therefore the change will probably not lead to the same effect as Walmart has had.

Online Grocery

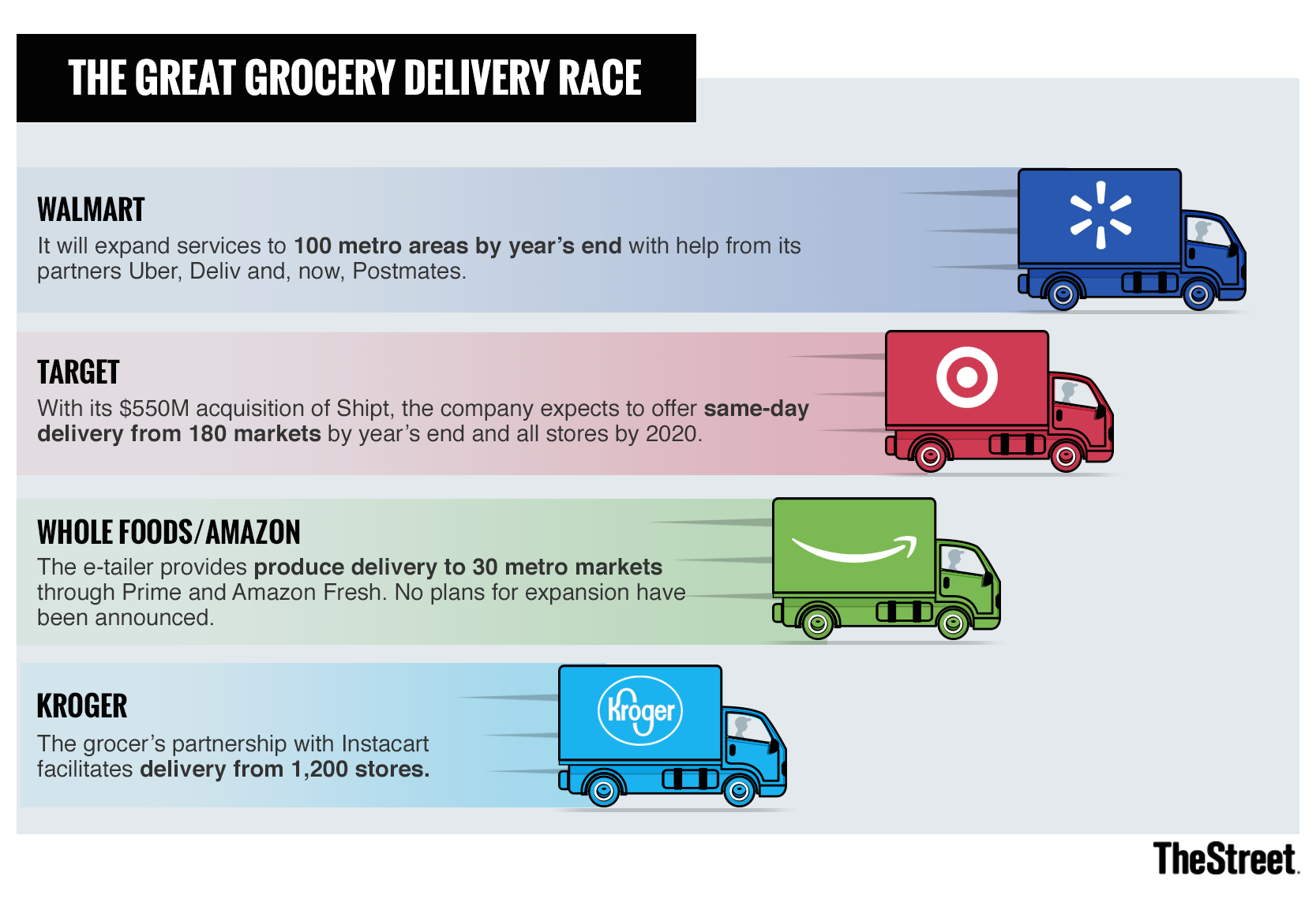

In November 2018, despite Amazon’s massive acquisition of Whole Foods, Walmart quietly eclipsed Amazon.com as the nation’s preferred online grocer. Now that Instacart has seized delivering groceries from Amazon’s Whole Foods locations as of December 2018, it opens the door for Walmart to take the wide open lead in digital grocery sales. Walmart continues to dominate by giving more shoppers the option of buying their bread, milk and produce from their smartphones. With more than 37,000 trained personal shoppers helping to fill the baskets and a massive delivery network powered by Point Pickup, Skipcart, AxleHire and Roadie to deliver them, Walmart is poised to win the great grocery delivery race by a mile.

Takeaways and Opportunities

Walmart’s acquisition of Jet.com for $3.3 billion in 2016 was met with subjective criticism from many industry analysts. Nearly 2 years to the day later, Walmart made headlines again by acquiring FlipKart for a staggering $16 billion. Retail columnist for Bloomberg Opinion, Sarah Halzack says that she thinks “[Walmart] made a good call in agreeing to shell out $16 billion on a controlling stake in Indian e-commerce heavyweight Flipkart. One side effect of that, though, is that I suspect investors won't have the stomach for more major acquisitions in the near term.” This is good word of caution to consider, but for Walmart is doesn’t apply as much because they are not actively seeking investments at the same rate as companies such as Amazon are. If Walmart’s eCommerce efforts don’t pan out, they still have their brick-and-mortar side to sustain their growth without breaking a sweat.

We are a digital agency that strategize, design, and build exceptional digital experiences that solve complex brand challenges.

Propane, Creative Agency

1153 Mission Street

San Francisco, CA - 94103

415 550 8692